Thank you so much! With my background of working with refugee-oriented NGOs across Eastern Europe, the opportunity to study international law at Kent and forge friendships with people from all over the world was outstanding.

Provide opportunities for American students to come to Kent

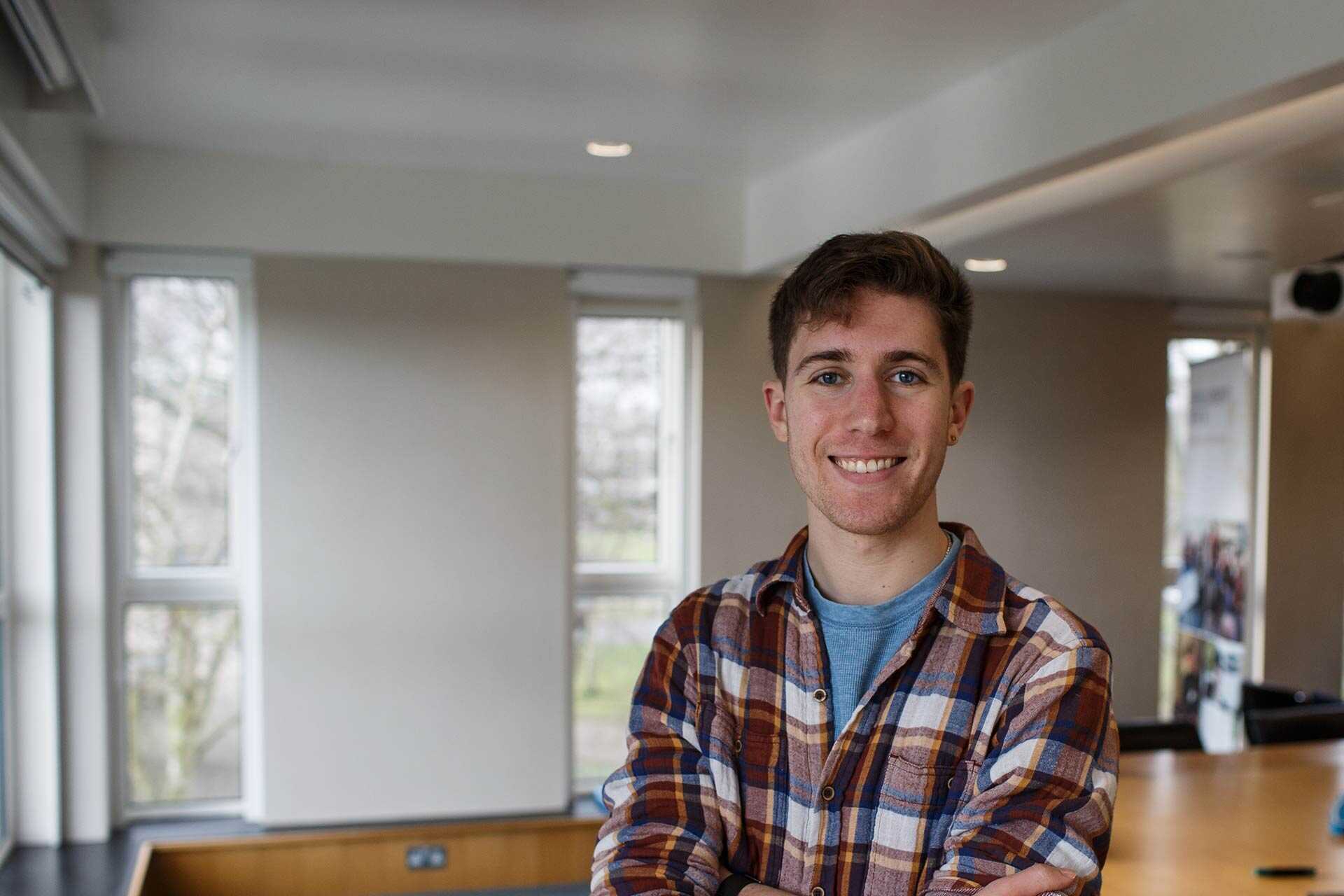

Julian Schneider attended the University of Kent as one of our University of Kent in America Fulbright Scholars. This prestigious scholarship attracts some of the brightest students from across the US to cross the pond and pursue a Master's degree in their chosen subject.

This is only made possible by the generosity of our American alumni and friends. And in order for us to provide more such opportunities, we need your support.

About our fundraising in the US

In 2005 the University of Kent established the University of Kent in America Inc, a separate charity with 501(c) (3) status, so that alumni and friends in the US who wish to make gifts to the University of Kent can benefit from the US income tax deduction available to charitable donors in the USA. The University of Kent itself has also been recognised as a prescribed foreign university under section 3503 of the Canadian Income Tax Regulations.

UKA Inc raises funds for causes specific to the interests of Kent alumni and friends based in the USA. Grants from the charity will fund initiatives such as scholarships to help American students study at Kent, hardship grants for American students already at Kent, faculty exchanges or to enable a Kent lecturer to conduct a lecture tour in the USA.

The former president of the newly established Board of UKA Inc, John Covell K67, launched the fund through a gift of shares, the value of which was matched by his company.

Tax deductions for US tax-payers

Alumni and friends who pay tax in the United States are eligible for tax deductions on the gifts they make to the University. By making your gift to the University of Kent in America Inc, your gift will be tax deductible to the maximum extent allowed under US law. Tax deductions apply to gifts of cash, shares and property made either now or in your will.

Contact us

If you would like more information about UKA Inc. please contact alumni@kent.ac.uk or write to:

UKA Treasurer

417 Mansfield Rd

Silver Spring

MD 20910

USA