Our former colleague Professor Jagjit Chadha, expert on financial markets and monetary policy, now director of NIESR, returned to our economics community to give a talk about central banking. But with such an experienced and entertaining speaker, it was great to hear him go ‘off road’.

‘I have strong positive memories of my time here.’ Professor Jagjit Chadha, began, reminiscing about the School of Economics under four different Heads, concluding ‘how nice everyone is here! I work in Whitehall, meeting people in Westminster, so it strikes me what a wonderful place and a sanctuary it is in this particular university and this particular department!’ He also extended the invitation for anyone in the room, visiting Westminster to come and meet him for coffee!

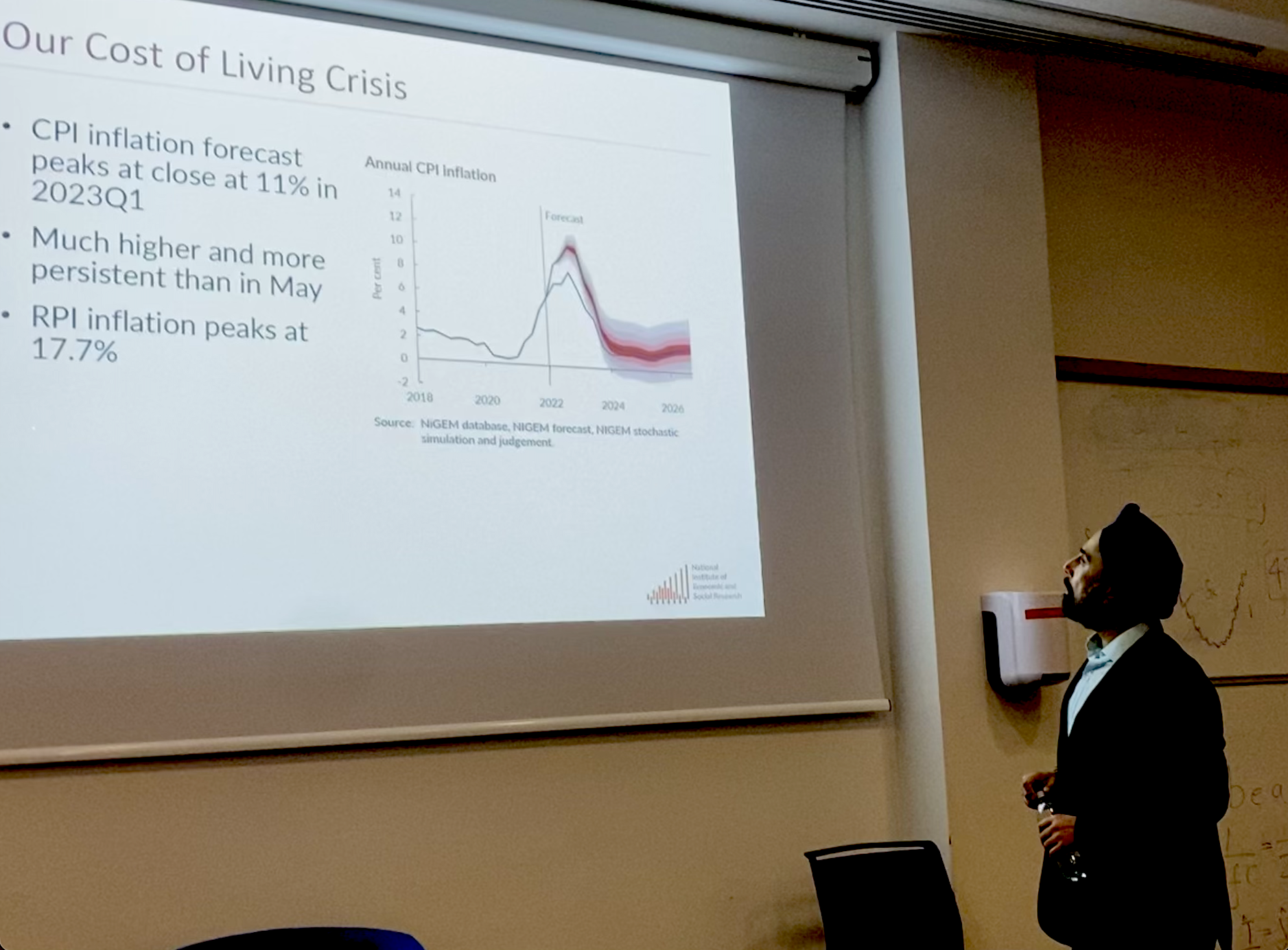

Chadha had come to us to talk about Central Banking and specifically his recent publication The Money Minders, The Parables, Trade-offs and Lags of Central Banking but digressed giving us a ‘walk back through New Labour’, the 2008 financial crisis, furlough, inflation instability from the 1700s to present day, the effects of the Ukraine war on the cost of living, admitting ‘I can talk about Quantitive Easing ’til the cows come home’.

‘We’re living through some extraordinary times. I’d love to explain what the heck has been going on since 23 September 2022 (the mini-budget).’

Should central banks be doing something different? Was the main drive of his talk, however. ‘We need to try and bring price stability, without compromising output volatility, which can lead to wide scale social distress. We need the Bank of England to bring inflation down slowly rather than quickly.’

‘This has turned into a discussion on the state of the U.K. economy, rather than a discussion on Central Banking. I’ve gone off piste, sorry Miguel!’

Looking back to how the Bank of England dealt with Trussonomic shocks he concluded that ‘given the sheer uncertainty and concern, I think we did as much as we could’ but conceded that ‘the narrative you can place on something after the event is very different from how it appears in real time.’

‘The mini budget and the way it blew up the financial markets, and the reversal of the policy interventions of the time and a recommitment to a more conventional approach, reversed almost immediately what had come before. The wonderful upshot of the idiocy that we saw is that there’s no chance that this government will unwind The Bank of England’s mandate but there are still some questions about how we help the worse off.’

‘Above all, we have got to think very clearly about how are we going to achieve productivity growth in the future because, if we don’t, we will live with higher levels of disparity within the country.’